Please note that, as I am writing this in late spring of 2025, revenue figures for some companies from 2024 still remain unavailable to the general public, but most of the data you will read in this article is from 2024, so I have the full set of comparable data between companies. This delay can stem from a variety of factors, that include; extended audit timelines, international operations, financial confirmations, or late filings with regulatory bodies. For public companies, these delays aren’t uncommon.

What are the top revenue-generating industrial robot companies in 2024?

Industrial robotics companies are responsible for advancing automation in the robotics industry. Each industrial robotic system must execute functions and commands for material handling, dispensing systems, paint, inspection, palletizing, CNC machining, arc welding, or mechanical joining. The robotic arm is highly proficient at high speeds, keeping its movements accurate. This article will examine the top revenue-generating industrial robot companies and their automation equipment.

Manufacturers choose to invest in an industrial robot brand because of their specific ability to perform complex robotic system tasks. The ability to provide an automation solution for their customers by optimizing sophisticated robotic system movements is necessary for each robotics company in the automation industry. When optimized, these machines can improve a customer’s throughput and ease the workload on their operators.

Main Types of Industrial Robots:

Before I start talking about the top industrial robot companies, it is essential to understand what industrial robots are and are not.

Industrial Robots Are Not:

- Collaborative Robots (Cobots)

- Remote-Controlled Drones

- Voice Assistants

- Autonomous Cars

- Software

- Automated Guided Vehicles (AGVs)

- Autonomous Mobile Robots (AMRs)

- Wearable devices

- Artificial Intelligence (AI)

Industrial Robots Are:

Below, I list the four main types of industrial robots as defined by the International Standards Organization (ISO) [1]:

Cartesian Robots:

A cartesian robot will move along three axes in the X, Y, and Z directions. The robot will use one linear actuator for each of its axes. The payloads are usually smaller because of the size and strength of the gripper.

SCARA Robots:

A SCARA (Selective Compliance Assembly Robot Arm) robot will have a small footprint on a single pedestal-mounted robotic arm. SCARA robots are faster and more expensive than cartesian robots.

Delta (Parallel) Robots:

These high-speed robots use kinematic chains connected to the base with an end-effector or gripper. Most delta robot motors drive ridged actuators that can handle high-volume workloads.

Articulated (6-Axis) Robots:

Articulated robots are the most commonly used in the manufacturing and automotive industry. They can handle payloads as large as a vehicle and be as precise as the millimeter. They can be used for many different robot applications, such as; material handling and visual inspection, and even as a welding robot.

Who are the top industrial robot manufacturers globally?

Below, I list some of the top companies globally who manufacture industrial robots:

- ABB

- Cloos

- Comau

- Daihen Corporation

- Denso Robotics

- Doosan Robotics

- Epson

- Fanuc

- IGM Robotic Systems, Inc.

- Kawasaki Robotics

- KUKA

- Mitsubishi Electric Automation

- Nachi

- Omron Automation

- Panasonic

- Stabuli

- Yaskawa (Motoman)

How many industrial robots are currently operating around the world?

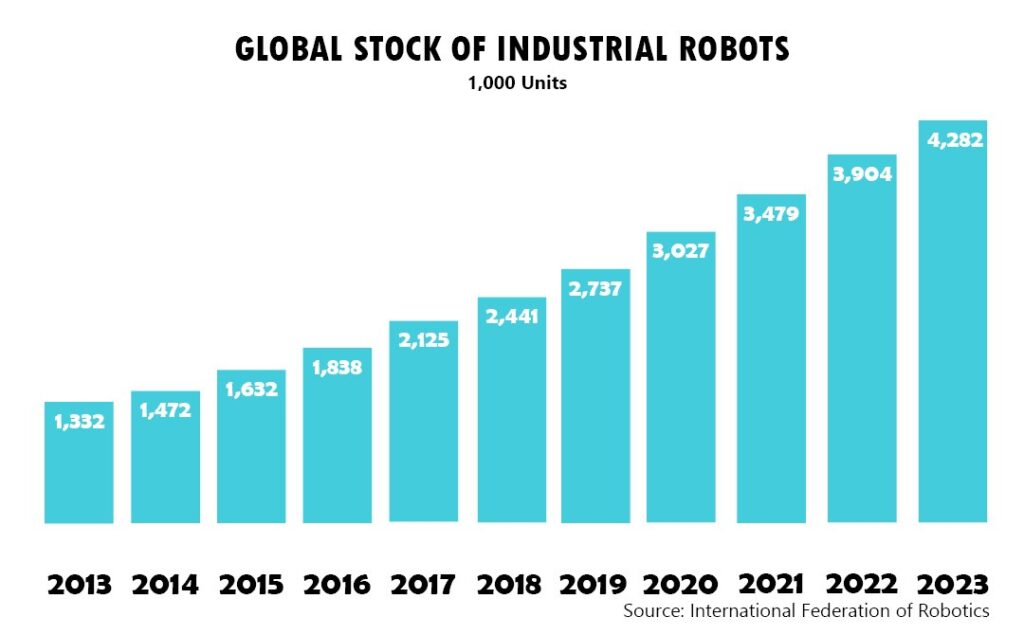

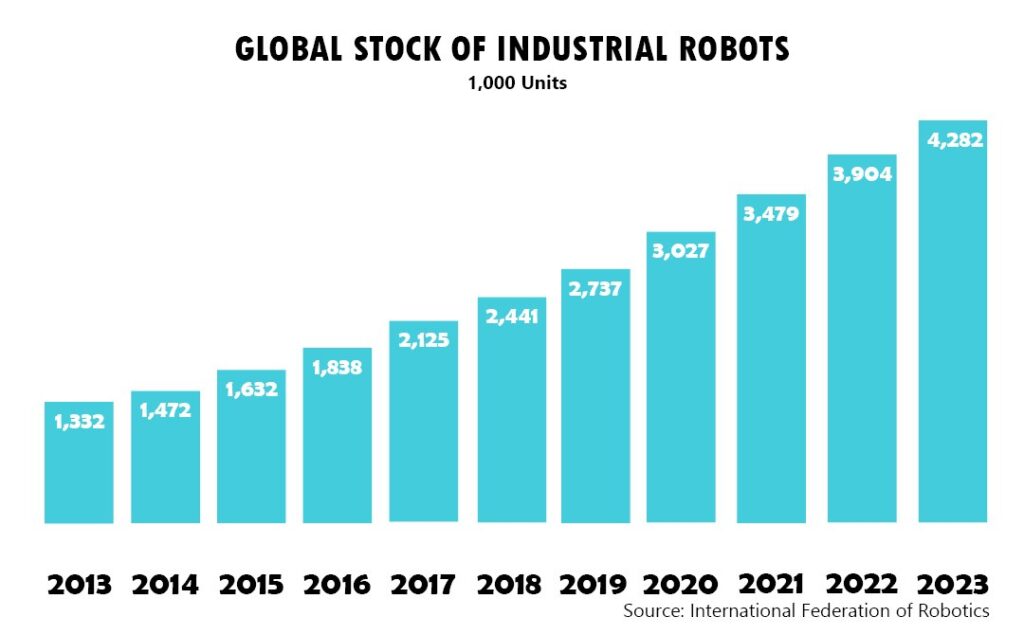

The International Federation of Robotics (IFR) claimed that in 2024, approximately 4.3 million industrial robots were operating worldwide [2]. This does not include collaborative robot companies like Universal Robots or robotics companies like Boston Dynamics. This was an overall industrial robot increase of 10% compared to the previous year.

Although the operational use of robots has decreased, the trajectory of the number of robots installed has slightly increased from 2022. The average annual robot growth rate will explode to catch up with rising automation demand. In 2026 and 2027, industrial robot units installed are expected to reach over 550,000 units annually [2].

Annual installations of industrial robots in the United States were up 10% from 2022 to 2023. Overall, robot sales in North America have declined by 8% in the first half of 2024. Companies based in Mexico, Canada, and the United States saw industrial robot orders decrease by 30% compared to 2022 and 2023 [4].

Sales for industrial robots seem to be trending down for North America, while in Europe and Asia, the trend continues to move upward.

Top 10 countries that installed industrial robots in 2022:

Below, I list the countries who recorded the most industrial robots installations.

- China: +290,300

- Japan: +50,400

- United States of America: +39,600

- Republic of Korea: +31,700

- Germany: +25,600

- Italy: +11,500

- Chinese Taipei: +7,800

- France: +7,400

- Mexico: +6,000

- Singapore: +5,900

Source: World Robotics 2023 [5]

The Top Revenue-Generating Industrial Robot Companies in 2024:

I have assembled the list of the top robotics companies based on the number of each company’s revenue from their industrial automation systems sales. The global industrial robot market was worth over 50 billion dollars in 2024.

#7 NACHI ($1.66B)

Nachi Robotic Systems Inc. has a variety of industrial robot models. Nachi offers 52 SCARA and 6-axis articulated robots. They support multiple types of robotic applications, from arc welding, dispensing, material handling, machine tending, palletizing, press tending, spot welding, and many more.

Nachi holds its United States corporate headquarters in Novi, Michigan.

#7 KAWASAKI HEAVY ($1.84B)

Kawasaki Heavy Industries has a large selection of industrial robotic products from pharmaceutical, welding, sealing, cleaning robots, and pick and place. They are one of the global leaders, Kawasaki robotics automation systems have sold over 210,000 industrial robots.

Their United States headquarters is located in Wixom, Michigan.

#5 YASKAWA ($3.65B)

Yaskawa Motoman offers 25 different types of industrial robots in its portfolio. These robots include; welding, cutting, assembly, handling, packaging, palletizing, painting, and dispensing. Depending on your application, Motoman robots can have high payloads, rapid movements, and significant work envelopes.

The United States corporate headquarters of Yaskawa America, Inc. is located in Waukegan, Illinois.

#4 KUKA ($3.7B)

KUKA Robotics offers 24 different types of industrial robots. Every KUKA robot in their portfolio has a wide range of options, starting with their delta, cartesian, articulated, and linear robots.

The United States headquarters of KUKA Robotics Corporation is located in Shelby Township, Michigan.

#3 FANUC ($5.48B)

The FANUC Corporation has more than 100 industrial robot models. FANUC offers SCARA, delta, articulated, and even cobots. If a business is looking to optimize a process, FANUC robots will likely have an automated solution because they offer the widest variety of industrial robots.

FANUC holds its United States corporate headquarters in Rochester Hills, Michigan.

#2 ABB LTD ($32.9B)

ABB Robotics offers 26 types of industrial robots. Its industrial automation segment focuses on articulated, delta, SCARA, and paint, which hold payloads anywhere from 3 kg to 800 kg.

ABB’s American headquarters is in Cary, North Carolina.

#1 MITSUBISHI ELECTRIC ($36.5B)

Mitsubishi’s industrial robot revenue was almost double its closest competitor’s. These robots are equipped with high speed and extreme precision. Mitsubishi offers robots with easy-to-use pick and place functions to robots with complex assembly tasks. They also have intelligent packages for vision, sensing, and integration.

The United States headquarters for Mitsubishi Electric Automation, Inc. is located in Vernon Hills, Illinois.

The Industrial Robot Automation Industry:

Although robots have now made it into a growing number of industrial industries, like the food and beverage, and plastic and chemical industries, the highly automated electrical/electronics industry became the most extensive application area for electro-mechanical machines, followed by the automotive industry.

The robotics industry’s growth trend is primarily driven by rising wage levels that force manufacturers worldwide to replace human labor with machines. Robot programmer jobs are on the rise as well. China leads the way with the most robotic installations, with 276,000 in 2023, followed by Japan (46,000), the United States of America (38,000), South Korea (31,000), and finally Germany with 28,000 robots installed. [3]

This makes sense as Asia is home to many robot manufacturing companies, including Nachi, Yaskawa Electric Corporation, Fanuc, Kawasaki, and Mitsubishi, requiring robot programming services. The global control systems and industrial automation market was valued at $206 billion in 2024. The industrial robot segment will account for the most significant revenue increase. Like the industrial robotics market, the factory automation, artificial intelligence, industry 4.0, and controls systems market is forecast to compound an annual growth rate of 10.8% from 2025 to 2030 [13]. This industry comprises various products and services, including relays, switches, sensors, drives, machine vision, control systems, and software development and services. Conglomerates like Siemens, Rockwell Automation, Mitsubishi Electric, Omron Automation, Schneider, and General Electric are significant industrial automation vendors and industry software.

Popular Robotic Companies Revenue in 2024:

Boston Dynamics ($27.6M)

Boston Dynamics is an engineering robotics company that builds robots and simulation software for humans. The company started as a spin-off from MIT (Massachusetts Institute of Technology), where they first developed robots that maneuvered like animals. Organizations like the Marine Corps, Navy, and U.S. Army turn to Boston Dynamics for advice on creating the most advanced robotics on Earth.

The headquarters for Boston Dynamics is located in Waltham, Massachusetts.

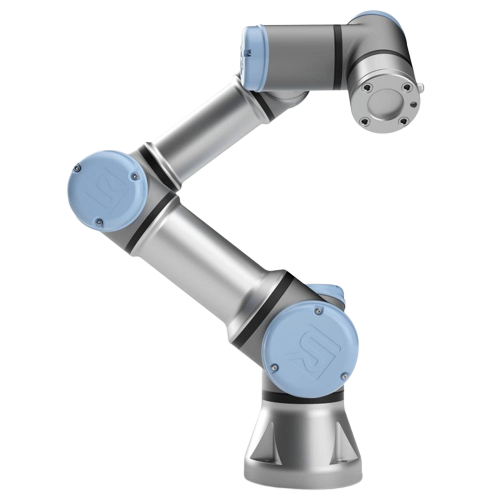

Universal Robots in 2023 ($304M)

Universal Robots are one of the world’s largest collaborative robot (also known as cobot) manufacturers. They have sold over 50,000 cobots and are used in production environments worldwide. Cobots are easier to program and faster to deploy compared to industrial robots.

Universal Robots headquarters is in Odense, Denmark.

iRobot ($681.8M)

iRobot is one of the largest robot vacuum cleaning companies in the world. Their autonomous home vacuum cleaners are some of the most popular brands in the robot vacuum space.

The company has its U.S. headquarters in Bedford, Massachusetts.

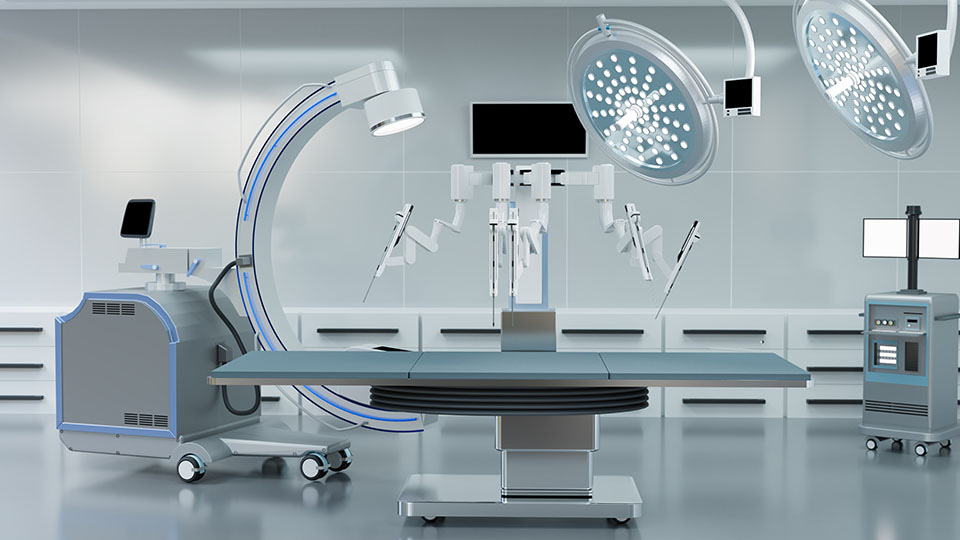

Intuitive Surgical ($8.35B)

Intuitive Surgical, Inc. is a robotics company that develops, manufactures, and markets robotic products in the healthcare industry. Their medical robots perform minimally invasive surgery that is more precise than using the hands of a doctor.

The headquarters for Intuitive Surgical is located in Sunnyvale, California.

Rockwell Automation ($8.09B)

Rockwell Automation, Inc. provides its main products for industrial automation and digital transformation technologies. The organization is structured into three major brands: FactoryTalk software, Allen-Bradley PLCs, and LifecycleIQ Services.

Rockwell Automation holds its headquarters in Milwaukee, Wisconsin.

Siemens AG ($82.10B)

Siemens is a technology company focusing on industrial, transportation, healthcare, and infrastructure. They are one of the largest industrial manufacturing companies in the world. Their key focus is on automation, digitalization, and industrialization.

The United States headquarters for Siemens is located in Washington, D.C.

Need industrial robot support? Use JOINER Services!

JOINER Services offers flexible, fast, and highly specialized staffing solutions tailored for the industrial automation industry. Our contractors are proven experts in robot programming, integration, troubleshooting, and production support. Our contract robot experts are ready to step in and keep your operations running smoothly without long-term commitments.

JOINER Services eliminates the headache of recruiting, vetting, and onboarding specialized talent by providing pre-qualified professionals who can deliver results from day one.

Whether covering a short-term gap, scaling for a project, or managing peaks in demand, JOINER Services ensures you get the right skills exactly when and where you need them, minimizing downtime and improving production line inefficiencies.

Get started and join today for free!

FREQUENTLY ASKED QUESTIONS:

Below, I list some common FAQs about industrial robot companies.

Data Resources:

[1] International Organization for Standardization

https://www.iso.org/home.html

[2] IFR World Robotics report says 4M robots are operating in factories globally

https://www.therobotreport.com/ifr-4-million-robots-operating-globally-world-robotics-report/

[3]Annual industrial robots installed in top five countrieshttps://ourworldindata.org/grapher/annual-industrial-robots-installed

[4] North American robot sales decline 8% in first half of 2024 https://www.therobotreport.com/north-american-robot-sales-decline-8-percent-first-half-2024/

[5] World Robotics 2023 Report: Asia ahead of Europe and the Americas https://ifr.org/ifr-press-releases/news/world-robotics-2023-report-asia-ahead-of-europe-and-the-americas

[6] Revenue for Nachi-Fujikoshi

https://companiesmarketcap.com/nachi-fujikoshi/revenue/

[7] Kawasaki Heavy Industries, Ltd.: Financial Results for FY2023: Kawasaki Heavy Industries, Ltd.

https://global.kawasaki.com/en/corp/ir/library/pdf/pre_240509-1e.pdf

[8] Revenue for Yaskawa

https://companiesmarketcap.com/yaskawa/revenue/

[9] Challenging financial year 2024 for KUKA

https://www.kuka.com/en-us/company/press/news/2025/04/kuka-financial-figures-2024

[10] Fanuc Revenue 2011-2024 |FANUY https://macrotrends.net/stocks/charts/FANUY/fanuc/revenue#:~:text=Fanuc%20annual%20revenue%20for%202024,a%2025.89%25%20increase%20from%202021

[11] Q4 2024 results

https://new.abb.com/news/detail/123065/q4-2024-results

[12] Mitsubishi Electric Group 2024 INTEGRATED REPORT https://www.mitsubishielectric.com/investors/library/integrated_report/pdf/2024/integrated_report2024_en.pdf

[13] Market Size & Trends

https://www.grandviewresearch.com/industry-analysis/industrial-automation-market

[14] Boston Dynamics’s revenue

https://www.zippia.com/boston-dynamics-careers-1206628/revenue/

[15] Universal Robots reports strong end to 2023

https://www.universal-robots.com/about-universal-robots/news-centre/universal-robots-reports-strong-end-to-2023/

[16] iRobot Reports Fourth-Quarter and Full-Year 2024 Financial Results https://investor.irobot.com/news-releases/news-release-details/irobot-reports-fourth-quarter-and-full-year-2024-financial

[17] Intuitive Surgical Revenue 2010-2025 https://www.macrotrends.net/stocks/charts/ISRG/intuitive-surgical/revenue#:~:text=Intuitive%20Surgical%20annual%20revenue%20for,a%208.97%25%20increase%20from%202021

[18] Rockwell Automation Revenue 2010-2024

https://www.macrotrends.net/stocks/charts/ROK/rockwell-automation/revenue#:~:text=Rockwell%20Automation%20revenue%20for%20the%20twelve%20months%20ending%20December%2031,a%2010.9%25%20increase%20from%202021.

[19] Siemens AG Revenue 2010-2024 https://www.macrotrends.net/stocks/charts/SIEGY/siemens-ag/revenue#:~:text=Siemens%20AG%20revenue%20for%20the,a%206.5%25%20increase%20from%202022