The idea that one should start planning early for retirement is often articulated to one another, especially when starting your work career. Although most people agree that saving for early retirement is a good idea, there is some resistance to early retirement from engineers who feel they may quickly become bored with all of the downtime.

Many people think saving for retirement is challenging. Still, this article will show options for an early retirement plan for contract engineers, ensuring you have enough money to pursue your dreams during these relaxing years.

Contract engineers earn excellent hourly wages and usually work countless hours during a project. Many can easily make more than six figures a year, and while earning a larger salary, they can and should maximize annual deposits into their retirement accounts.

Types of retirement accounts for contract engineers:

Below, I list some great retirement savings account options for contract engineers.

- 401K:This account is generally for W2 employees, and they often have employer contributions in the retirement account for eligible employees.

- Solo 401K: An account for individual business owners or 1099 self-employed workers without employees.

- Traditional Individual Retirement Account (IRA): This is for anyone with earned income.

- ROTH IRA: Similar to the IRA account, only the contributions are added after taxation, so the account is not taxed during withdrawal.

- Simplified Employee Pension (SEP) IRA: This type of IRA is for 1099 self-employed individuals or small business owners with several employees.

- Savings Incentive Match Plan (SIMPLE) IRA: This account is for employees who work for a company that has less than 100 employees.

Allowable Retirement Savings

Of the accounts listed, an engineer could save a maximum of this amount for 2024.

- 401K: Maximum contribution limit of $23,000.

- Solo 401K: Maximum contribution limit of $69,000.

- Traditional IRA: Maximum contribution limit of $7,000 for those under the age of 50.

- ROTH IRA: Maximum contribution limit of $7,000.

- SEP IRA: Maximum contribution limit of $69,000 or up to 25% of the year’s compensation.

- SIMPLE IRA: Maximum contribution limit of $16,000, with an additional $3,500 for those over 50.

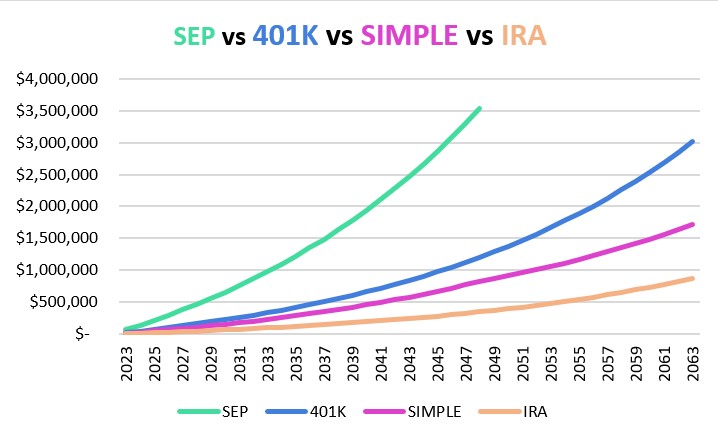

From the graph shown below, one can easily see why where a person works can significantly impact their retirement savings. Many employed contractors decide to leave their employer and become 1099 self-employed contractors because of the significant savings allocation differences between the retirement account types.

Maximum allowable retirement contributions per each account type:

You are on your way to early retirement if you maximize your savings now!

By simply maximizing contributions into the retirement fund, in just 25 years as a 1099 self-employed worker could save over 3.5 million dollars for retirement in a SEP IRA account, compared to a 40-year career of a W2 employee who would only reach about $3.0 million in savings in a 401K account.

Even if you didn’t start as a 1099 self-employed worker, you can immediately transition your career in your 30s, 40s, or 50s and boost your retirement funding. If you are interested in a career as a 1099 contract engineer, check out the JOINER Careers to learn more about becoming an independent contract engineer.

What if I cannot afford to maximize my retirement contributions?

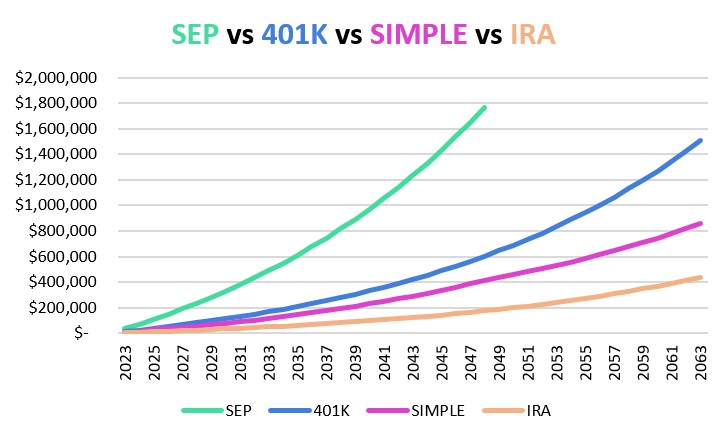

Only some have the luxury of maximizing their contributions for retirement, so what if you could only contribute half of the maximum allowable? The graph below shows a similar savings total, but the SEP account stopped contributing 15 years before the other retirement accounts.

Half of the allowable retirement contributions were saved for these accounts:

This time, the SEP-IRA contributions were only $34,500 a year, and the 401K contributions were $11,500 annually. Again, in only 25 years, the 1099 self-employed contractor could save more ($1.8 million) in a SEP IRA account than the W2 employee ($1.5 million) saved after 40 years.

What Are the Benefits of Contracting Before Retirement?

Below, I list the three key retirement benefits of working as a contractor.

- Greater Control During Your Career: One of the more significant benefits of contracting is obtaining more control over your contract jobs. As an independent contractor, you enjoy the project flexibility and self-sufficiency of being your own boss. This means you can select contract work and focus on the projects you are most interested in working on.

- Maximize Your Earning Potential: Becoming a self-employed contractor can be a lucrative way for technically experienced engineering professionals to promote the knowledge they’ve built over their careers to clients who are more than willing to pay for their technical skills. This means they earn more money than ordinary engineers and can afford then to save more for retirement than the average engineer.

- Maximize Your Savings Potential: Most contract engineers make an excellent living financially, but the retirement savings programs offered to W2 employees differ from self-employed individuals. No matter your worker status, the important part is maximizing your retirement accounts every year.

Work occasionally while retired

Engineers often return to their profession after “retirement” as temporary contract jobs get proposed with attractive rates, paid by the hour. At this stage in their careers, they can easily choose each project they’d like to work on, as their knowledge and experience are often highly regarded within the industry. These engineers often enter back into the manufacturing industry as 1099 self-employed workers. Many find themselves on platforms like JOINER Services to find new customers and pick specific projects to work on.

How much should you save for retirement?

A certain percentage of workers always opt out of early retirement. This is usually because of the rising health care costs and increasing insurance costs. The best option may be to wait until they are eligible for Social Security for these employees. According to Fidelity Investments, you save approximately 15% of your monthly income for retirement planning.

The career path for early retirement!

If a person considers that they would like to retire early, then pursuing work as a contract engineer is an excellent choice because of the amount of overtime that one can earn. Whether you work as a W2 employee or a 1099 independent contract engineer, you must find what work will interest you the most. While it is often more enjoyable to work on new technologies than older technology, the older equipment and tools often offer more security and the potential for greater earning power because fewer people need to learn how to run and maintain the product appropriately.

Early Retirement Planning

Retire early as a contract engineer may also be made for financial reasons. Choosing to retire early can be a significant financial decision. Still, it will also allow the person to use that money to pursue other interests once they are no longer working within their industry.

People retire earlier than expected when investments or retirement savings perform better than initially expected. Saving earlier in one’s career or choosing the proper retirement account can make or break a person’s expected retirement date.

Contract engineers may also end up in early retirement because they are offered an early retirement package. This often happens to engineers when an organization is restructuring engineering roles within a company, and they want to support staff who have been with the organization for many years.

What is the average retirement age?

Most American workers expect to retire at 66 years old, but the average age of retirement in America is 61 years old, according to a 2022 Gallup poll. The actual retirement age of 61 has slowly crept upward over the last 20 years. Many people are not working as long as they planned, highlighting the importance of establishing a retirement plan early in one’s career.

Retirement Facts:

Below, I list retirement facts that most engineers do not know about retirement.

- The average IRA balance is $110,800 in Q2 2022.

- The average 401(k) balance is $103,800 in Q2 2022.

- Only a third of American workers will have enough retirement income to retire safely when turning 67.

- Only 19% of Americans are expected to gather retirement savings above their goal amount.

Key Retirement Savings Takeaways:

Below, I discuss the five key takeaways from this retirement planning article.

- You can save about 3X more with a SEP IRA account over a 401K.

- Becoming a self-employed contractor mid-career can help boost your retirement funds.

- After retirement, you can work sparingly on projects as a self-employed contract engineer.

- When you decide to retire or how you work to save, make your retirement savings a priority.

- You want to save at least eight times your annual salary for your retirement income.

Retirement Planning Conclusion

The best thing to do to ensure that you are putting yourself in an excellent financial position for retirement is to seek help from a professional. Financial advisors or planners specialize in providing retirement solutions to make your dollars stretch further so that when you actually retire, you are put in the best position possible. Engineers who do not have a financial plan in place could unknowingly lose out on opportunities to invest and live comfortably later in life.

The earlier you save for retirement, the better. While investing 15% of your salary into a retirement plan, the numbers prove time and time again that you will be better off financially when you decide to retire. Create strong saving habits while you are young so you can have the financial security you desire in retirement. Hopefully, this article brought some added attention to the retirement options for contract engineers on where to start saving for retirement so you can live comfortably well into your elder years.

The information that I provided in this article is not intended to constitute legal or financial advice. This article is for informational purposes only and not for personal financial advice. There is always inherent risks involved with financial decisions, and the website owner and author will not be held liable for it. Always consult with a professional financial advisor to discuss your personal financial plan and retirement options.

Data Resources:

- [1] https://www.irs.gov/

- [2] https://www.fidelity.com/viewpoints/retirement/how-much-money-should-I-save

- [3] https://news.gallup.com/poll/394943/retiring-planning-retire-later.aspx

- [4] https://newsroom.fidelity.com/press-releases/news-details/2022/Fidelity-Q2-2022-Retirement-Analysis-Even-With-Market–Economic-Uncertainty-Retirement-Savers-Look-Long-Term-and-Continue-to-Save/default.aspx