The way cars are made is changing, and its changing fast. From the materials used to the technology inside the car, everything is being rethought. The auto industry is changing; modernizing car design, assembly, and delivery is a must to keep up with rising consumer expectations.

It’s not just about what’s under the hood anymore. Smart features, clean energy, digital sales, and ongoing support services are shaping how each vehicle is produced. Automakers and their tier suppliers alike are adjusting to what the market values, becoming more flexible, and learning how to support over the long-term instead of just one-time sales.

Top 10 automotive manufacturing trends.

In this article, I breaking down the top 10 automotive manufacturing trends making the biggest impact right now. These trends aren’t predictions for the future, they’re already happening!

1. The rise of electric vehicles:

Electric vehicles (EVs) are gaining significant momentum, both on the road and in the factory. In 2023, over 14 million EVs were sold worldwide, and they now account for about 18% of total car sales globally, according to the International Energy Agency (IEA) [1]. Lower battery prices and more charging stations mean that number will climb even faster. Perhaps even more so when full-battery electric vehicles become more common than hybrid cars.

Governments are also promoting the shift by offering tax breaks and implementing stricter CO2 emissions regulations. Automakers are responding by building more EV models and reshaping their factories to support the electrified platforms. J.P. Morgan expects EVs to make up roughly 59% of global new car sales by 2035[2]. That kind of growth means big changes for automotive manufacturing, especially around the assembly of battery electric vehicles, supply chains, and new materials.

EVs aren’t just changing how we drive. They are changing how cars are manufactured, from design to production. Factories are trying to adapt fast but will electric vehicle adoption truly continue to grow, we will have to wait and see.

2. More focus on advanced driverless assistance systems:

Advanced Driver Assistance Systems (ADAS) are becoming the new normal in modern passenger cars. Features like lane-keeping, adaptive cruise control, and automatic emergency braking are no longer just “nice to have”. They’re expected by many drivers and, in some places, required by law.

The ADAS market is growing fast. According to a 2025 report by Market Research Future via GlobeNewswire, the global ADAS market is set to grow at a rate of 16.5% per year, reaching $91.37 billion by 2029 [3].

What’s behind this growth? Two key factors: stricter safety regulations and enhanced software with AI features. Car manufacturers are incorporating more cameras, advanced sensors, and software to assist drivers in avoiding crashes and staying alert. Some systems even adjust to your habits and driving style. For automakers, this means redesigning cars from the inside out while integrating innovative technology directly into the vehicle.

3. Further development of autonomous vehicles:

Self-driving cars aren’t science fiction anymore. They’re being tested on real roads right now. While we’re not at full automation just yet, the industry is making steady progress through levels of autonomous driving, from basic driver support to hands-free highway driving.

Manufacturers are investing heavily in sensors, artificial intelligence, and onboard computing. Some pilot programs are already live, and the tech is improving quickly.

Let’s take a look at a few real-world examples:

- Waymo: Runs a fully autonomous ride-hailing service in Phoenix, Arizona.

- Cruise: Testing driverless taxis in San Francisco.

- Tesla Autopilot and Full Self-Driving (FSD): Offers highway automation but still requires driver attention.

- Mercedes-Benz Drive Pilot: Certified for hands-off driving on certain highways in Germany and the U.S.

- Amazon Zoox: Testing a custom-built autonomous vehicle with no steering wheel.

For automotive companies, this shift means building cars around new hardware, such as cameras, radar, LiDAR, and advanced computer chips. Safety testing and software updates are now a bigger priority. We’re not fully autonomous yet, but we’re a lot closer than we were just a few years ago.

4. Increased sustainability:

As the world shifts away from combustion engine vehicles, vehicle manufacturing factories are also being redesigned to reduce emissions, save energy, and use more recyclable materials. Below, I list several ways companies are practicing sustainable manufacturing.

Key moves driving greener car production include:

- Switching to natural refrigerants in testing equipment.

- Using recycled or bio-based materials in interiors.

- Reducing factory water and electricity use.

- Improving wastewater management.

- Updating older energy-consuming products with more eco-friendly equipment.

These changes aren’t just about ticking boxes, they’re tied to new business models that appeal to buyers who care about the planet. Making cars cleaner from the start is becoming just as important as building them for the lowest possible price. As more companies get on board, eco-focused manufacturing will likely become the standard, not the exception.

5. Prioritization of vehicle connectivity:

Cars are getting smarter and more connected every year. Modern cars connect to your phone, GPS, Wi-Fi, and in the near future, to other vehicles.

Convenience is only part of it, and it goes beyond simple ease os use for the driver. Sensors, computer chips, and software inside cars collect and send data simultaneously as things occur. Drivers get information instantaneously, manufacturers can send updates wirelessly, and as a result, we get safer roads for drivers and passengers.

Here’s what connected cars can do:

- Send drivers maintenance service alerts.

- Update software wirelessly via Bluetooth connection or the cars Wi-Fi system.

- Share traffic and road data, like accident alerts or emergency traffic notifications.

- Using an app for car functions like locking doors or remote start.

- Track the vehicle’s overall health by detecting and alerting drivers to potential issues.

- Connect to smart infrastructure.

For auto manufacturers, this means a greater focus on cybersecurity, reliable hardware, and robust digitally connected systems. This connected technology will support new services, such as usage-based insurance or in-car payments.

6. 3D printing for production:

3D printing is becoming more common in the automotive industry. It’s not just for prototyping parts anymore. Manufacturers are utilizing it to produce fasteners, custom-fabricated parts, and even employing 3D printing for weight reduction in certain plastic components.

According to Meticulous Research, the automotive 3D printing market is expected to hit $17.9 billion by 2032, growing at a 22% annual rate. [4] So, what is causing this 3D printing surge? It saves time, reduces waste, and enables the use of lightweight parts that enhance fuel efficiency. This is a significant factor because EVs can weigh at least 30% more than standard internal combustion engines (ICE). It’s also a big win for customer flexibility, especially when it comes to creating personalized or low-volume parts for car owners.

How is 3D printing being used?

- Rapid prototyping to test design and feasibility quickly.

- Custom-built parts and components for special models or high-end trims.

- Lightweight materials to help meet emission standards.

- Tooling and manufacturing aids to speed up production lines.

- Fasteners, clips, and other shapes that previously stamping or cold forming were unable to produce.

- Shorter supply chains by producing parts closer to the point of manufacturing.

As more auto manufacturers focus on electric and hybrid models, 3D printing will play a key role in developing high-performance prototypes, fasteners, and components. It’s helping the industry move faster while cutting production costs without sacrificing quality.

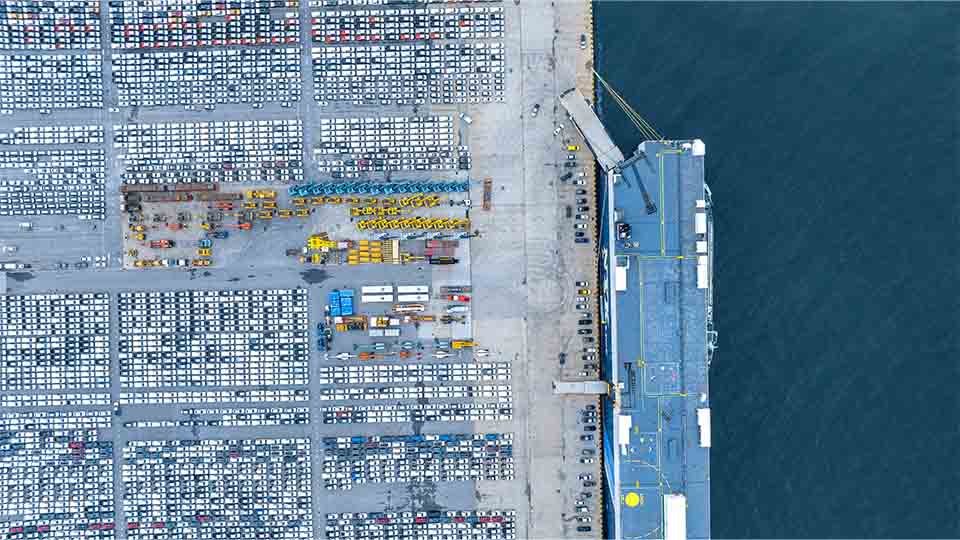

7. Supply chain diversification:

The last few years have exposed serious weak spots in the auto industry’s supply chain. Shortages in chips, metals, and even tariffs have brought production to a halt in many places. Now, building a stronger, more flexible supply chain has become a top priority for many original equipment manufacturers (OEMs).

One of the biggest automotive industry trends is the diversification of your supply chain. Companies are reducing their reliance on single suppliers and spreading risk across multiple regions. Some are even bringing parts of their supply chain closer to their manufacturing in a “make where you sell” campaign. This shift helps reduce delays and maintain production continuity when global disruptions occur.

These OEMs are also investing in smarter real-time tracking tools and digital forecasting to try to catch these potential issues early. They’re working more closely with domestic suppliers and keeping more critical parts on hand.

This isn’t just a short-term fix. A more resilient supply chain gives automakers the flexibility to adjust quickly to consumer demand, or global and economic shifts. As cars get more complex and more connected, building that kind of flexibility into the system is key to staying ahead.

8. Online car sales:

Buying a car online isn’t as rare as it used to be. According to the EY Mobility Consumer Index, 25% of car buyers now prefer to complete their car purchase online, up from just 18% in 2021. That includes buying directly through automaker websites or third-party platforms. At the same time, dealerships haven’t been left behind. In fact, 61% of buyers still want to finish their purchase at a dealership, and 66% say they want to experience the car in person before making a decision [5].

This shows that the shift isn’t fully digital, but rather a hybrid model where people conduct research and comparisons online, while still relying on dealerships for the final step. For many shoppers, especially EV skeptics, talking to a salesperson and seeing the car up close helps them feel more confident. That’s why digital tools and physical stores are now working together. Shoppers are narrowing down choices online, then going to see the car in person to then finalize the deal.

As this trend grows, automakers are updating their online platforms and offering services like digital financing, home delivery, and virtual test drives. It’s all about making the process easier while still giving buyers the car buying experience they want.

9. Everything as a service:

The auto industry isn’t just focused on selling cars anymore. Many manufacturers are offering extra services around the vehicle to create new, long-term revenue streams. It’s a shift from one-time sales to ongoing relationships.

This approach is picking up speed in 2025 as more automakers explore “car-as-a-service” options. The global XaaS (Everything-as-a-Service) market, which includes mobility and auto services, is expected to grow from $699.79 billion in 2023 to $3,221.96 billion by 2030 [6]. That’s a clear sign that services are becoming just as valuable as the car itself.

These services include:

- Vehicle subscriptions: Drivers pay monthly to access a car, sometimes swapping models based on their needs.

- Bundled packages: Insurance, maintenance, and roadside assistance wrapped into a single monthly payment.

- Usage-based services: Pay-per-mile insurance or fees tied to how often certain features are used.

- In-car upgrades: Software-based features like heated seats, advanced navigation, or faster charging, available on demand.

- Remote diagnostics and maintenance alerts: Helping drivers stay ahead of repairs.

This model gives automotive manufacturers a steady income while improving the driver experience. It also supports flexible ownership or subscribing based on what works best for each customer.

10. Growing demand for personalization and customization:

Today’s drivers don’t just want a car, they want their car. Personalization and customization have become major trends in the automotive world, and manufacturers are taking notice. Whether it’s the color, trim, features, or even in-car software, buyers are expecting more choices than ever before.

This shift is driven in part by the rise of online vehicle configurators, which let customers pick and preview their ideal setup before making a purchase. It’s also tied to changing expectations around ownership. People want cars that reflect their lifestyles, not just the basic models off the lot.

Here’s how automakers are responding:

- Offering more trim and feature combinations.

- Letting customers choose in-car software options or updates.

- Providing interior material and color customization.

- Allowing upgrades post-purchase through connected platforms.

- Using flexible manufacturing processes to handle unique builds.

This trend also works well with subscription models and software-defined vehicles, where drivers can activate or upgrade features over time. For manufacturers, personalization opens up new revenue streams while giving customers more control.

What these trends mean for auto manufacturers.

All of these trends are reshaping how the auto industry works. Building fully electric vehicles, adding smart tech, and offering services beyond the sale are becoming the standard. More than half of global car buyers now expect cleaner, more connected options, which puts real pressure on all of the automakers to keep up.

It’s not just the big brands feeling the shift. Automotive suppliers are being pushed to adapt as well, whether it’s delivering lightweight materials, smarter consumer electronics, or components ready for over-the-air updates. Everyone in the chain is being asked to move faster and think differently.

For auto manufacturers, this means balancing innovation with efficiency. The skills needed go far beyond traditional assembly lines. That’s why many companies are turning to engineering experts and consulting services to help close the gap. From integrating software and improving energy systems to redesigning factories and managing data, outside specialists can bring the right experience at the right time.

In a space where change is constant and expectations keep rising, having the right support makes all the difference. Staying competitive means being ready to adapt and knowing when to bring in extra help.

Stay ahead of manufacturing labor support issues with JOINER Services!

If you’re feeling the pressure to keep up with all these changes, you’re not alone. From building fully electric vehicles to rethinking supply chains and adding new automation services, today’s automotive industry is changing fast. And with more than half of buyers expecting smarter, more flexible options, the bar continues to rise.

As an OEM or automotive tier supplier, you need more than just good intentions, you need the right people with the right technical skills, ready to go when you are. That’s where JOINER Services can support your project with the right skilled labor.

JOINER Services helps companies find engineering contractors and consultants who can jump into your manufacturing projects and help you solve real-world problems fast. No red tape, no long hiring timelines. Just top talent, ready to help you move forward with confidence and expert knowledge.

Need support with robot programming, automation systems, quality support, or factory upgrades? JOINER Services makes it easy to hire the right person for the job!

Join now and see how using JOINER Services for your temporary staffing support can help your next project be successful.

FREQUENTLY ASKED QUESTIONS:

Below, I discuss some FAQs about automotive manufacturing trends.

Data Resources:

- [1] Electric Vehicles https://www.iea.org/energy-system/transport/electric-vehicles

- [2] What is the electric vehicle (EV) boom? https://www.chase.com/personal/investments/learning-and-insights/article/what-is-the-electric-vehicle-boom

- [3] Advanced Driver Assistance Systems (ADAS) Market Forecast Report 2025: ADAS Market Set for 16.5% CAGR, Reaching $91.37 Billion by 2029, with Regulatory Mandates and AI Integration Leading Growth https://www.globenewswire.com/news-release/2025/02/06/3022138/28124/en/Advanced-Driver-Assistance-Systems-ADAS-Market-Forecast-Report-2025-ADAS-Market-Set-for-16-5-CAGR-Reaching-91-37-Billion-by-2029-with-Regulatory-Mandates-and-AI-Integration-Leading.html

- [4] Automotive 3D Printing Market to be Worth $17.9 Billion by 2032 https://www.prnewswire.com/news-releases/automotive-3d-printing-market-to-be-worth-17-9-billion-by-2032exclusive-report-by-meticulous-research-302408003.html

- [5] One in four are buying cars online but dealerships will remain vital for move to EVs – EY Mobility Consumer Index https://www.ey.com/en_gl/newsroom/2024/01/one-in-four-are-buying-cars-online-but-dealerships-will-remain-vital-for-move-to-evs-ey-mobility-consumer-index

- [6] Everything as a Service Market Size https://www.fortunebusinessinsights.com/everything-as-a-service-xaas-market-102096